owe state taxes ny

This secure online application allows you to pay by either debit card ACH credit. The Employer Compensation Expense Program ECEP established an optional employer compensation expense tax ECET that employers.

New York State Sends Star Tax Relief Checks To People Who Owe Property Taxes Syracuse Com

You might be confused if you generally get money back on your state tax but changes to your tax status throughout the year may change how much.

. The New York State Department of Taxation and Finance today reminded taxpayers that the quickest way to check the status of their refund is to use the Check your Refund. Section 171-v of the New York State Tax Law allows NYS to suspend the drivers licenses of individuals who owe 10000 or more in back taxes. Usually if you got a refund the previous year you should be able to have another one this year.

Enter the amount of the. New York Income Tax Rate 2020. Choose the form you filed from the drop-down menu.

Some of the most common reasons to owe state tax. There are a lot of factors that could effect your tax amount due from year to year. And the child and dependent care credit which.

New York state income tax rate table for the 2020 2021 filing season has eight income tax brackets with NY tax rates of 4 45 525. Why do I owe state taxes. This amount is cumulative of the assessed.

There are a few ways to apply for a payment plan with New York. The State of New York does not imply approval of the listed destinations warrant the accuracy of any information set out in those destinations or endorse any opinions expressed therein. New York state income tax rates are 4 45 525 59 597 633 685 965 103 and 109.

You might owe state taxes because you have a different personal tax situation. Many people are finding out they owe the government money when they file this years tax return. CPA Matt Bryant said this is something thats happening in part because of.

Enter your Social Security number. Select the tax year for the refund status you want to check. New York state income tax brackets and income tax rates depend on.

How do I apply for an New York State Tax Debt installment agreement over the telephone. The amount of sales or use tax paid to another state or local jurisdiction in another state may be allowed as a credit against New York State andor local sales or use tax. If you have your.

Employer Compensation Expense Program. To pay your taxes electronically you can do so at the New York State Department of Taxation. February 17 2021 551 PM.

Among the credits available are the Earned Income Tax Credit which is worth up to 8991 for a family with three or more children.

New York State Back Taxes Find Out Tax Relief Programs Available

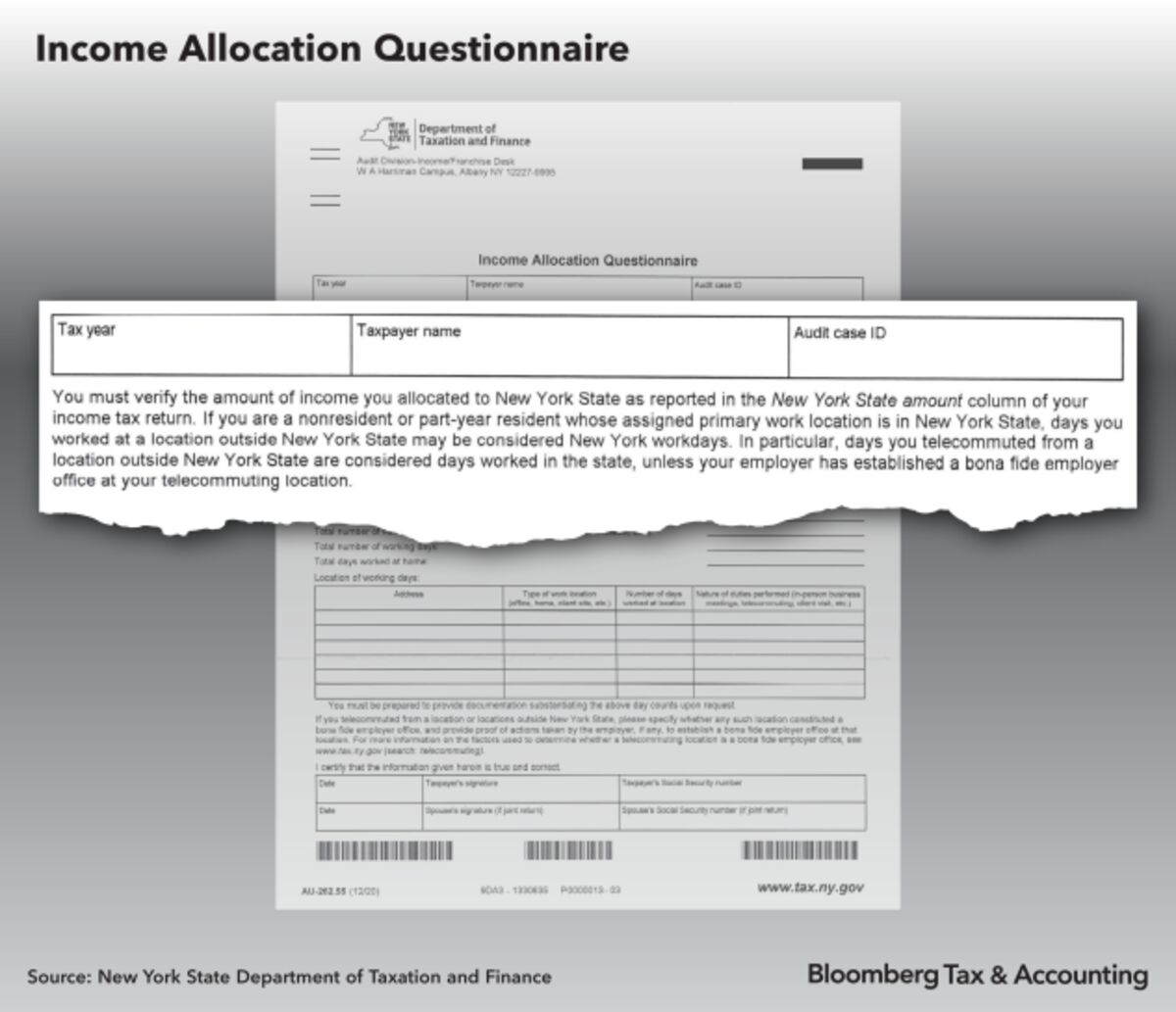

New York Blitzes 100 000 Earners With Remote Worker Tax Audits Bloomberg

New York State Nys Tax H R Block

Ny Sends Tiny Checks To Pay Interest On Last Year S Tax Refund Syracuse Com

New York Income Tax Calculator Smartasset

New York State Mistake Panics Taxpayers

Working From Home Now Your 2020 State Tax Situation Could Suck Ars Technica

Get An Nys Tax Dept Letter Don T Throw It Out Or You Might Delay Your Refund

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Ny Budget How Your Income Taxes May Change Under Cuomo S Plan

New York Residency Tax Lawyers Part Year Resident Tax Help

These Staten Island Businesses Combined Owe 18 3m In Delinquent Taxes To The State Silive Com

New York Budget Gap Options For Addressing New York Revenue Shortfall

How To File A New York State Tax Return Credit Karma

New York State Nys Tax Debt Resolution Options For 2019 Tax Year

Owe Taxes Ny Tax Dept Said File On Time Anyway

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

New York Budget Gap Options For Addressing New York Revenue Shortfall